Read time: Under 5 minutes.

Authors: Nathan King Phil Gray

Is Automotive at a Crossroads?

The Automotive Industry was already grappling with huge challenges and opportunities – not least Brexit, zero-carbon emission targets and weakening consumer confidence. However could the global pandemic, whilst painful in the short-term, prove to be the catalyst for the scale of investment and behaviour change required?

Context

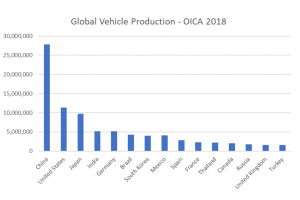

Automotive is a Global Industry that annually produces 95.6m vehicles. 90% of vehicles were sourced from the top 15 countries, with China, United States and Japan producing over half. The UK was ranked 14th having produced 1.6m vehicles around 2% of global production.

Source: OICA – 2018

Whilst a modest player on the world stage, the Automotive Sector is vital to the UK economy, employing 823,000 people across the nationwide supply chain, generating a turnover of £82bn and accounting for 14.4% or £44bn of the UK’s total exported goods (82% of all Cars and 59% of all Commercial Vehicles produced in the UK). Source: SMMT – 2018.

The Bigger Picture

The Automotive Sector is highly complex, with global manufacturers and supply chains facing into multiple challenges and opportunities. These include connectivity (through digitisation of the cockpit), autonomy (through development of self-driving vehicles) and shared mobility (through access to transportation services).

However, arguably the biggest trend is towards increased electrification. Environmental concerns around global warming has seen Governments make significant CO2 reduction commitments. In the UK, this has led to a ban on the sale of all new petrol, diesel or hybrid cars by 2035, which by YTD March 2020 represented 96% of new vehicle registrations, hence giving the Automotive Industry fewer than 15 years to completely reconfigure the current business models away from the internal combustion engine.

Global Pandemic

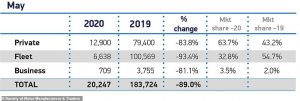

As well as the wider impact on society, Covid-19 has dealt the Automotive Industry a heavy blow, with entire supply chains shut down and demand collapsing, evidenced by UK New Car Registrations in May down 89% compared to 2019.

As the lockdown eases, dealers have been working hard to adapt to the ‘next normal’ and re-open Servicing and Showrooms. Crown Honda’s re-start video is an excellent example of the Industry’s ‘Best in Class’ response to deliver a “Distancing that Delights” customer experience.

Short Term Prospects

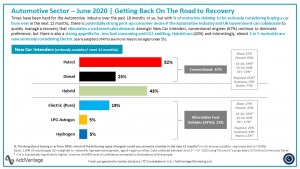

As the UK Government lifts lockdown measures, a recent survey we commissioned to understand purchase intent for new cars in the next 12 months, offers much needed hope for the Industry suggesting potentially strong pent-up consumer desire:

- ¾ of motorists claim to be seriously considering buying a car from new in the next 12 months

- Amongst new car intenders, conventional engines (67%) continue to dominate preference

- But there is also a strong appetite for, less fuel consuming and CO2 emitting, Hybrid cars (43%)

- Interestingly, almost 1 in 5 motorists are now seriously considering Electric

- Early adopters of AFVs are more likely to be aged under 35

Long Term Prospects

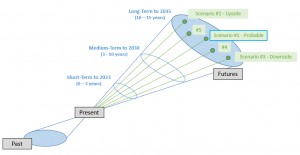

Whilst pent-up consumer demand can be discerned, this is by no means assured. However, the seismic shock from the Global pandemic provides a unique opportunity for both Government and Industry to make bold long-term decisions and investments.

Taking a scenario planning approach, given the over-riding objective is to phase out the internal combustion engine (ICE) by 2035 at the latest, the key is to define the success factors to bring that about, and then make the short-term choices which set the Industry on a path to meet the long-term goal.

Some of the long-term success factors would include:

- Alternative Fuel Vehicles on cost parity or below that of diesel/ petrol/ hybrids (ICE)

- Extensive infrastructure in place to assuage consumers with range anxiety

- Industry players remain sufficiently profitable to invest in the necessary changes

Given these factors, legitimate short-term initiatives could include:

- Incentives: Subsidies focused on AFVs comparable to that announced by the German Government, potentially a tipping point for consumer switching to more environmentally friendly options at a time of exciting new EV ‘product’ launches

- Infrastructure: Private and Public partnerships to collaborate on developing technology and platforms – for example, a resilient fast charging network (in & out of home) underpinned UK-wide by Electricity Utility suppliers

Conclusion

Whilst the pandemic has had a huge short-term impact, with the right policy decisions taken across Government and Industry, the shock provides the opportunity to make the step-change in investment across Consumer, Industry and Government to meet long-term goals.

About The Authors

Nathan King | AddVantage

What do we do? AddVantage is a business strategy and research partner for scale-up and advanced growth organisations seeking to reduce risk on major market initiatives and improve productivity to scale and grow.

How do we do it? We support clients in two main ways:

- By increasing confidence in market related decisions through an objective approach that blends strategic frameworks, hypotheses and research to uncover evidence-based insights.

- By enhanced planning, control and ways of working to step-change productivity and free-up time to work more ‘on’ the business to scale and growth effectively.

Contact: m: +44 (0) 7970 188057 | e: Nathan | w: AddVantage | In: nathanrjking

Phil Gray | Constellation-I

What do we do? Constellation-I helps organisations to reduce the risk and increase the confidence in decision-making with expert independent evidence-based consumer and marketing insights.

How do we do it? By unlocking the value in understanding Consumer Motivations, Stakeholder Engagement and New Product & Service Ideas.

Contact: m: +44 (0) 7973 794434 | e: insightphil | In: insightphil

AddVantage – Fresh perspectives for better decisions