Read time: Under 3 minutes.

Author: Nathan King

In my preparation for a macro-environment lecture delivered jointly in early 2020 with Ainurul Rosli (Reader in Enterprise and Entrepreneurship – pictured) to a new cohort of talented Post Graduate students at Brunel University, I reflected on two main areas.

PESTLE ANALYSIS

The first was to identify some interesting, topical and thought-provoking real-life examples for each of the PESTLE (Political, Economic, Social, Technology, Legal and Environmental) dimensions, the classic framework for organising macro-environment scanning. These included:

- Social: The issue of inter-generational financial conflict exacerbated by home ownership, with its implications for government housing policy and the construction business was explored, referencing an excellent article from the Economist.

- Environment: Making the link from the near universally acknowledged climate crisis to the trend to reducing meat consumption in favour of vegetables, impacting food producers and retailers, supported by data from foodbev.com.

The second related to my observations on the levels of maturity of environmental scanning across small to large organisations, culminating in key take-outs on best practice.

ENVIRONMENTAL SCANNING MATURITY

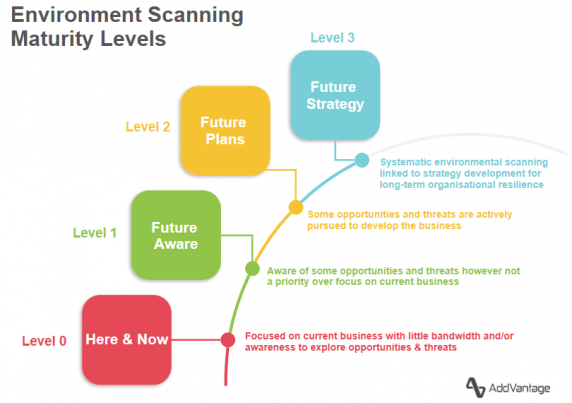

On the environmental scanning maturity levels, there is a continuum ranging from:

- Completely focused on the ‘here & now’, hence at risk of missing opportunities and threats.

- To ‘future strategy’ where an organisation systematically scans the external environment to inform strategic planning, hence proactively leverages opportunities and mitigates risks to support building long-term organisational resilience.

The maturity levels are summarised below:

BEST PRACTICE

Several actionable take-outs can be discerned from consideration of the organisations operating at the most mature level of environmental scanning:

- Strategic process: Environmental scanning is an integral part of strategy development, both as an output to answer specific strategic questions and an input to inform thinking on future strategic options.

- Fresh perspectives: Whilst there is a wealth of publicly available information (for example industry reports, on-line articles, trade shows etc.) that should be mined, this insight is clearly accessible to competitors too. In order to build competitive advantage, it’s hence prudent to supplement secondary information with targeted primary research that seeks to answer strategically important questions typically around:

- Where to play – Explore key market out reaches beyond the short-range business radar to determine market potential and develop hypotheses for growth.

- Who to play with – Build off existing customer knowledge to deepen insight on their needs and characteristics to support account planning and test growth hypotheses.

- How to play – Minimise time and investment risk through refinement and stress-test of propositions and go-to-market plan to maximise chances of success.

- ‘So What?’ test: There is a risk that environmental scanning becomes an academic, tick-box exercise with insights too generic to shape strategic thinking. This can be avoided through:

- Long-term goals: Start with the end in mind and set clear long-term (5-10 year) business goals. These goals set the future direction and hence the context from which the impact of external factors can be judged, articulated both in financial (such as revenue, margins and profit) and business characteristics (such as number of staff, markets operating, customer profile etc.), so it’s clear what success looks like.

- Scenario planning: The critical step often missed once the goal is set, is to identify the underlying assumptions on the critical factors that would need to happen to deliver the goals. This can be articulated in several ways including the level of competition, innovation and financial security. This takes some lateral thinking but if done well allows the setting of key results and performance indicators, which will make the assessment of potential opportunities and threats considerably easier.

- Objective assessment: A diverse team with different perspectives, reviews the output from the environmental scanning to discern the degree of impact and likelihood, using the business goals and success factors as objective anchors to inform decision-making.

- SWOT: The most important environmental factors from the objective assessment are then added to the ‘opportunities’ and ‘threats’ box in the business SWOT as input to the wider strategic process, with analysis and assumptions as support.