Read time: Under 10 minutes.

Author: Nathan King

Executive Summary

- 3D Printing (or Additive Manufacturing), is a manufacturing process that layer-by-layer builds a three-dimensional object typically from polymers, metals and ceramics.

- The global 3D printing market was valued at c.$10 billion at the end of 2019 and expected to treble in size within five years to around $30 billion by the end of 2024.

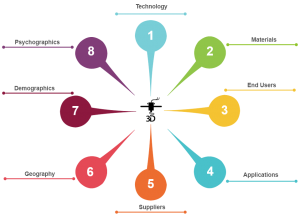

- The market can be structured in several ways such as technologies, materials, end user industry verticals, applications and supplier types.

- The key dynamics driving this expected growth are the expansion of uses beyond the prototyping heartland, reinvention of entire business models in concert with other Industry 4.0 technologies and the reduction of the adoption barriers of cost, accessibility and performance.

- A survey of 1,600 consumers found penetration of 3D Printers in UK homes stands at only 3%, indicating a significant gap to reaching consumer mainstream acceptance.

- In contrast, a survey of 900 global companies found 18% now use 3D Printing in production of end parts and components, hence can conclude that this technology has now gained acceptance within the Industrial mainstream.

What Is 3D Printing?

3D Printing, also known as Additive Manufacturing, is a manufacturing process, alongside Casting, Labelling & Painting, Moulding, Forming, Machining and Joining (Source: Wikipedia).

As the name suggests, 3D Printing is the process of designing and layer-by-layer building a three-dimensional object typically from polymers, metals and ceramics although other materials such as carbon, concrete and wood can also be used.

The global 3D printing market was valued at c.$10 billion at the end of 2019, with growth expectations of 20-30% compound annual growth rate (CAGR) to reach around $30 billion by the end of 2024 (source: Market Data Forecast).

For comparison, the global manufacturing value add in 2018 was c.$14 trillion (source: World Bank) hence whilst 3D Printing is growing fast it is from a small base.

To help answer the question on whether 3D Printing can breakthrough as a mainstream manufacturing process, we need to understand the market structure and dynamics.

How Is The 3D Printing Market Structured?

A fundamental concept in strategic marketing is that of market segmentation.

Why is it important?

Let us start with the demand side. In a large, growing market like 3D Printing, the potential buyers are in the millions (if you include the consumer sector), spread all around the world, all of which will have different use cases that drive a variety of needs as well as buying practices.

On the supply side, even the largest company only has finite resource to serve a market. Given the huge variation in potential customer requirements in each market served, market segmentation is needed as a compromise between mass marketing (treating everyone the same) and one-to-one marketing.

Whilst an organisation can grow using a more intuitive approach to customer development (indeed this is sometimes desirable in an emerging market), assuming there is an ambition to scale up and avoid stagnation, thinking through a tailored market segmentation is critical.

How is it done?

Market segmentation is a creative and analytical process that involves:

- Segmenting the market into distinctive groups.

- Choosing which of these groups are most attractive for an organisation.

- Positioning and marketing your product or service to attract business from the chosen market segments.

So much for the theory. How is the 3D Printing market segmented?

There are several ways in which the market can be segmented:

Considering each in turn:

- Technology: There are multiple technology processes available, the most popular being Fused Deposition Modelling (FDM) which heats a thermoplastic filament to melting point then extrudes it layer by layer to create the 3D object. The main technologies:

- Fused Deposition Modelling (FDM)

- Selective Laser Sintering (SLS)

- Stereo Lithography (SLA)

- Direct Metal Laser Sintering (DMLS)

- Material: The three main materials are polymers, metals and ceramics, however others such as carbon, concrete, food, human tissue and wood are also being developed.

- End User Industry: The end user ‘vertical’ sectors are typically seen as follows:

- Automotive

- Aerospace and Defence

- Architecture and Construction

- Consumer Goods (including Education, Entertainment, Food and Jewellery)

- Healthcare

- Industrial (including Chemicals, Engineering, Energy and Electronics)

- Applications: There are four broad uses, the first two – Prototyping and Tooling – focus on efficiency gains by saving time, materials and hence money. The last two – Spare Parts and End Components – present opportunities for growth and business model transformation and are key for 3D Printing to ‘go mainstream’.

- Prototyping: The founding use that continues to remain important, supports R&D iteratively develop new products by removing the need for traditional expensive and time-consuming tooling.

- Tooling: Building on prototyping, increasingly used to make locally customised tools such as machine parts, molds and jigs in the production process.

- Spare Parts: On demand local production of low volume but highly profitable end components for after sales.

- End Components: Specific use cases, such as hearing aids and dentistry parts, as well as large time-consuming bridges and boats, where 3D Printing can displace traditional manufacturing techniques.

- Suppliers: There are three main supplier components in the value chain:

- Hardware: Original Equipment Manufacturers (OEMs) and producers of the raw materials.

- Software: Developers of related software most notably for design, object scanning and model slicing (which turns the computer design into instructions a 3D Printer can use).

- Services: The scope for services is expanding and includes contract manufacturing and consulting.

- Geography: Countries and often economic regions.

- Demographic: For consumer markets, populations can be segmented on a variety of factors including age, gender, income, life stage and nationality.

- Psychographic: Buyers within both business and consumer markets, can be segmented on their behaviours and attitudes including lifestyle, activities & interests, values and personality types.

Every organisation will have a unique market segmentation. Typically this can be visualised in a four-quadrant grid with two sets of variables, that fits with their market definition, customer profile, products/services, business model and growth ambitions.

What Are The 3D Printing Market Dynamics?

There are many observable trends within 3D Printing, with industry experts giving their views in a recent 3D Printing Industry article. Arguably the three main dynamics relate to the expansion of uses, business model reinvention and barriers to adoption.

- Expansion of uses: Manufacturers, particularly within Aerospace, Healthcare and Chemicals, are finding new ways to utilise 3D Printing across the various applications to improve efficiency and pursue new growth opportunities (source: EY).

- Business model reinvention: Building off the knowledge gained from using 3D Printing primarily for prototyping, manufacturers are seeking to integrate the technology within other elements of Industry 4.0 to reinvent business models. Most notably is the strategic move to replace existing methods in the production of end components.

First coined by the German government in 2015, Industry 4.0 is seen as the latest phase of industrial development (source: Wikipedia):

- The first industrial revolution (1760-1840), involved the shift from hand production to steam & water powered machines, most notably within textile manufacturing.

- The second or technological revolution (1870-1914), led to a surge in productivity (as well as mass unemployment) through a combination of improved communication from the railways and telegraph, and factory electrification enabling the modern production line.

- The third or digital revolution (late 20th century) was the development of electronics and IT in computer and communications technology, further automating production.

- The fourth or smart revolution (which is ongoing) is the transformation of traditional manufacturing practices using smart technology such the Internet of Things (IoT), robotics and self-diagnosing machines. This will enable interoperability, information transparency, technical assistance, and decentralised decisions.

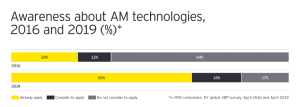

- Barriers to penetration: Predictably for a technology yet to fully scale, the three main barriers to implementing 3D Printing were identified as cost, accessibility and performance (source: 2019 business survey – EY).

- Cost: The most significant barriers were the cost of materials (90%) and the systems (87%).

- Accessibility: Lack of capability and knowledge in-house of design (50%), production processes (46%) and identifying use cases (40%) indicate the need to overcome technical barriers.

- Performance: Limitations on speed (41%), object size (36%) and materials indicate areas for technology improvements.

The eco-system of hardware, software and service providers need to continue to innovate to reduce these barriers to help unlock the potential of 3D Printing.

Is 3D Printing About To Go Mainstream?

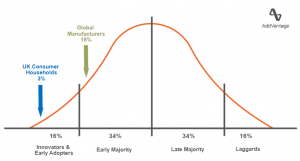

The ‘Technology Adoption Life Cycle Model’ developed by Geoffrey Moore (first set out in his book ‘Crossing The Chasm’), is a useful psychographic model that links buyer attitudes to market penetration of a technology product/service.

The concept applies a normal distribution to a given population, then splits it into five distinct customer groups according to level of penetration, each with their own characteristics.

The first two groups, the innovators (technology enthusiasts) and early adopters (visionaries), are most open to new ideas and make up 16% of the market penetration. The R&D departments using 3D Printing for Prototyping would be a classic target segment.

The third group, the early majority (pragmatists) making up 34% of the market penetration, are the most critical due to their size and ability to go beyond the initial, niche applications and represent breaking into the mainstream. These pragmatists are also the most challenging at this stage of market development, as they need more evidence than either the innovators or early adopters, to give them confidence to make big strategic decisions on new uses. For 3D Printing, this is likely to mean moving beyond the heartland of prototyping to develop new revenue streams for after-sales and transforming the business model to switch production methods for end components.

Consumer Lens

For many technologies, products and services, consumers make up an important part of the market and are needed to truly achieve mainstream status.

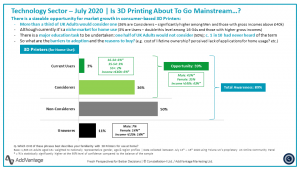

AddVantage Strategy commissioned a survey in July 2020 of over 1,600 UK Adults on their usage and consideration for owning a 3D Printer at home, with the key findings:

- Awareness: The 3D Printing industry has done a great job at driving awareness (89%).

- Penetration: In-home penetration at only 3% (no doubt centred on technology enthusiasts), indicates the consumer market is well below the 16% threshold considered mainstream. For comparison penetration of 2D printers (82%) and personal computers (98%) (source: Statista) shows both the headroom for growth for 3D Printing and the distance still to be travelled.

- Consideration: Whilst 36% of consumers claim they are considering owning a 3D Printer, a further 50% are not. The barriers to adoption around cost, accessibility and lack of compelling use cases, are likely to be even higher than with business professionals, so much work to be done to penetrate the consumer mainstream.

Industry Lens

Whilst 3D Printing is far from penetrating the consumer mainstream, more headway has been made with Industry. A survey in April 2019 of 900 global manufacturing companies indicated that 18% now use 3D Printing in serial production of end parts and components, so it has now broken into the Industrial mainstream.

Technology Adoption Life Cycle – Consumer and Industry Market Penetration

Conclusion

3D Printing is becoming an increasingly important manufacturing process, not least in its support for Industry 4.0, having now broken into the Industrial mainstream through penetration into end parts and components.

There remains much work still to do to overcome cost, accessibility and performance barriers to unlock the full market potential.

AddVantage – Fresh perspectives for better decisions